While I intend to focus principally on the general theory of deficit spending at the national level, let me first make a comment about the current US debt.

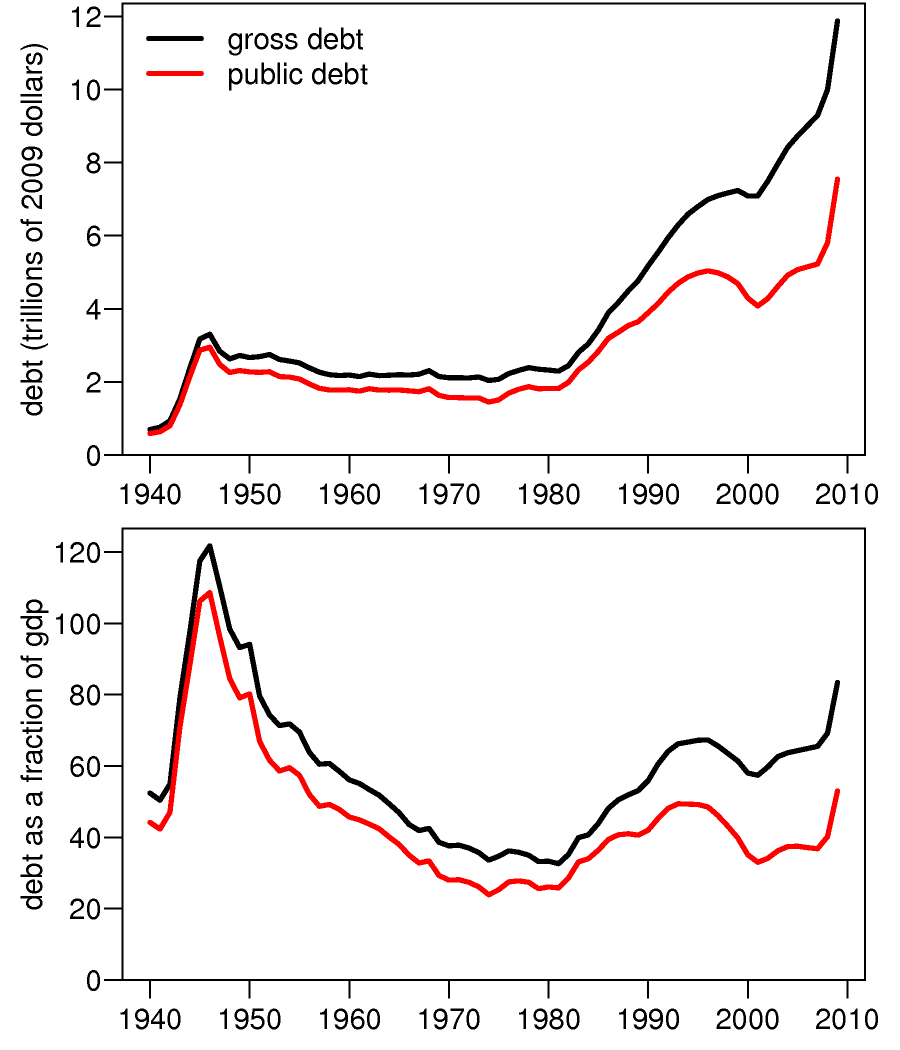

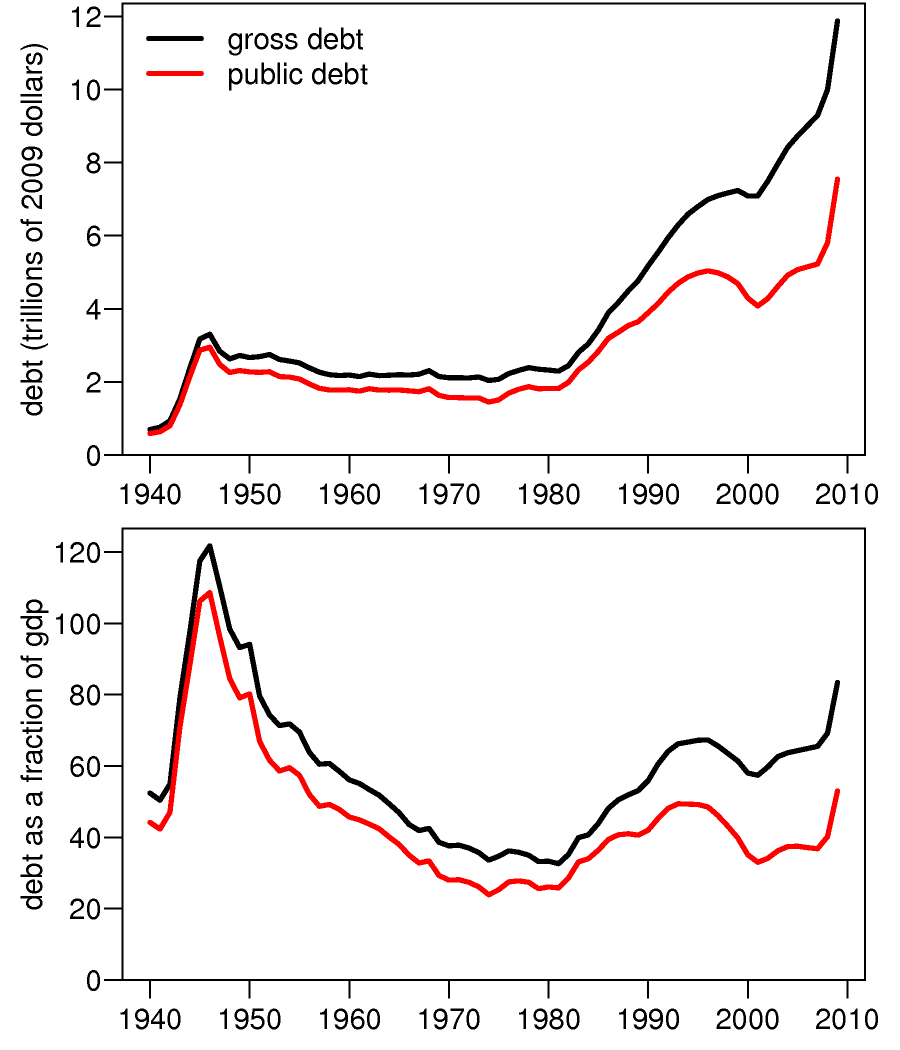

A mistake or lie — depending on how you view it and the person doing the talking — in looking at finances is to ignore the fact that the size of an economy generally grows at a compound rate. This means that if you look at a graph of something through time, the left side will always be very small, and the right side will always be very big. And in fact, not only will the left side be small, but so will the middle. The overall shape should appear something like the upper half of a trumpet’s bell. To see what is really happening, you need to remove that shape. Generally, that is either accomplished by correcting for inflation, or by showing values as a percentage of GDP. Of the two, the latter is perhaps a more meaningful statistic. Government revenue (i.e. tax) is closely linked to GDP, and the difficulties of financing the debt are based on revenue. The money supply can be inflated or deflated sporadically without any particular link to the growth of the economy, for instance via stimulus or changed interest rates at the Federal Reserve.

Here is an image of the national debt before and after being fixed to show the debt as a percentage of GDP:

National Debt - Dollars and as % of GDP (1940-2009)

It is also worth noting that the 2009 national debt is 26th in the world as a percentage of GDP. Ours is, in fact, only slightly above the global mean. See the last graph on the page in the following link (which includes many other lovely, lovely graphs). We are in fact a mere pittance compared to Austria, France, Switzerland, the UK, and Ireland.

http://www.marktaw.com/culture_and_media/politics/USA_debt_2009.html

It is also worth noting that while US tax revenue is scheduled to be surpassed by the national debt, that is not until between 2030 and 2040. We still have 20 to 30 years to refinance. I would not be surprised if raising taxes by 1% would put this off another 1 or 2 decades. Of course, lowering costs would be another and probably preferable solution.

In essence, my point is that the sky is not falling; in terms of debt, we have been far worse off than this and carried on just fine; if the sky is to fall, it is not anytime soon; and even should it do so, there is plenty of time to deal with it. Current budgetary animosity towards the US government by its populace is due to the recession not the national debt, and of course due to the media crying about the falling sky — either because they have little idea what they are talking about (most likely) or because sensationalism sells (less likely, but possible).

About Deficit Spending

Nearly every business operates on a deficit. A company is generally a growing organization and so it can expect that its future revenue will be larger and sufficient to pay off debt. For instance, let’s say that Jane has no money. She hires Scott to build a widget, taking out a loan of $10 to pay him. She is now in debt $10. Scott builds a widget and she sells it for $50. Now she has a few choices. She could just pay off her debt and hire four more employees with the remaining money. But, there’s no particular reason to do that. If she’s 90% confident that she could continue to sell widgets just as fast as she can sell them for the foreseeable future, there’s very little risk in taking out a new, even bigger loan. Instead of hiring just four workers, she can hire eight or ten, or even twenty. It just depends on how much confidence her and the loaning bank have in her ability to pay off both the loans and her employees with future widget sales. And so it goes with regular new loans, each bigger than the last until Jane or the banks sense that widget sales aren’t going to keep increasing. At that point finally, if it ever comes, the business will pay off all of its loans and have zero debt. Often, that point doesn’t come because the business can always expand to new markets, invent new products, find a way to reduce widget production costs, etc.

Now, you might say that a government, unlike a business, does not grow and so it has no need to operate on a deficit. But since the GDP grows with each year (generally), revenue does actually grow. Since that is decently reliable, there is no particular reason not to take advantage of it.

Government also contributes to the overall growth rate of GDP. If the establishment of an interstate highway increases trade among several cities, reduces their spending in transportation fees, etc. the GDP grows at a faster rate than if the government had done nothing. If the government can secure oil rights with Canada, or if it can make peace with Pakistan, or any number of things, it can act just the same — as regards the GDP and thus tax revenue — as a business entering a new market, inventing a new product, and so forth.

In times of crisis — for example during a war or during a recession — the government may need to “grow” one of its sectors rapidly to meet the emergency. Since emergencies are not really profitable — they just prevent growth to continue as it should — this does drain from the governments future revenues. This is true debt. I.e. it is not covered by future expected revenue growth. The only solution is to operate on a tighter budget for some period of time immediately following the emergency. How long that period must be will depend on how costly the emergency was and how long you can expect until there is an all new emergency.

If we look at the history of the US national debt it would seem that 30-40 years has always been a sufficient time frame regardless of the emergency. But at the same time it also appears that we have never had a period when we were not responding to an emergency or paying back that expense since the Civil War. (I would credit the spending increase between 1980-1995 to be due to response to the Cold War.) So, while theoretically, the government should be able to bank on increased revenues, and so there should be some more-or-less constant percentage of GDP that the debt should optimally be in non-emergency/non-payback mode, I’m not sure that we have ever been at that point. Previous to the Civil War, the understanding of macroeconomics and debt was worse so they likely tried to minimize debt simply because it was debt, and after that point we have not had a chance.

It seems that the national debt can fluctuate around 5% (as a percentage of GDP) in stable times. An increase of 10%+ can probably considered to be emergency spending. Including the current budget emergency, I count 8 emergencies since ~1860. This is an average of 1 per 18.75 years.

The faster that this debt is paid, the less money there is for the government to spend on highways, ambassadors, education, etc. The slower that it is paid, the greater a percentage that goes just to paying off the interest. This is, essentially, what is called Discretionary Spending. Only when debt becomes greater than the discretionary spending portion of tax revenue is there really an issue. As stated before, at the moment this is not scheduled to occur until between 2030 and 2040.

The Balanced Budget

The precise definition of a “balanced budget” can vary. Strict definitions require that revenue match spending. A far more loose definition — and the one that I would recommend — would be that revenues suffice for discretionary spending, and that all loans must be budgeted for an 18 year period (presuming that a crisis will occur again in roughly that time period).

There is also the question of what cases may be considered an emergency and whether one may change budgetary policy to respond to such. The Cato Institute’s proposed Balanced Budget Amendment, for example, provides no ability to respond to an emergency. The 1982 and 1997 proposals which went before the House of Representatives require either a declaration of war or a vote that the nation is under real military threat. No amendments that have been proposed for serious consideration have given any leeway for response to a recession. I am almost certain that only the fringe realm of economists would say anything other than that disallowing government response to recession is harmful. Besides recession, there is also issues of bailing out banks, or other large businesses and industries. Again, I’m fairly certain that nearly all economists would advocate that bailing out sufficiently large businesses is an economic necessity

Now I will note that there is two reasons not to trust economists. Firstly is that to a hammer, everything looks like a nail. To a macro-economist, government intervention is really the only tool they have to play with. Otherwise they really have no job beyond saying, “It will work itself out.” And second is that macroeconomic theory is still very much an uncertain and imprecise thing. The best and most influential theories for dealing with a recession, for example, are fairly shaky so far as I understand them.

That said, there are still several reasons that you should side with the economists. Firstly, they are themselves fairly aware of the limits of their understanding. They wouldn’t advocate a position unless they thought it had at least better than even odds of being the right answer, accepting the margins for error. Secondly, it has been demonstrated in the real world that a recession can persist for decades without intervention, so the theory that “it will work itself out” certainly doesn’t seem to be the winner. And lastly, a limited government has no ability to be a great government. It cannot be creative and it cannot be exceptional.

The Exceptional Government

All but one state in the US has a balanced budget requirement in their law. This includes California, which you might note has been going through a budgetary crisis.

Now, it’s a basic rule in life that the squeaky wheel gets the grease. The profession of sales is essentially the profession of being a squeaky wheel, for example. If you are intrusive and persistent, you get the deal.

Government policy by-and-large is set principally as responses to emergencies. Very rarely is there some sort of long-term strategy. Simply put, there can’t be since every 4-8 years someone else takes the reins and nixes most of everything you have done — much to the lament of NASA, whose projects each take 20+ years from point of inception. So if you ask yourself why (nearly) every state has a balanced budget rule, that answer is almost certainly going to be that there was some sort of fiscal crisis which was so large that the big hand came down to slap it.

And then you consider that of all government organizations, the one that gets the greatest amount of attention from the public and with the budget that is largest and hence has the greatest impact — of any government organization that would be most liable to get slapped with a balanced budget rule if it misbehaved, it would be the Federal government. And yet it hasn’t.

My personal theory for why that would be is that politicians are, themselves, a sort of market. The ones who are insane, incompetent, or lack charisma will stay at the bottom. For each point that they gain towards sanity, competence, and charisma, the higher they can climb in the ladder. If you look at city or local government, almost certainly everyone is insane and moronic. At the level of state, they are probably about like your average person. At the level of the Federal government, it’s a decent bet that most of them are fairly sharp individuals. You might not agree with them, but they are still fairly bright. Unfortunately, it is generally the work of state or local government that we encounter from day-to-day and this gives an impression that the all government is run by loons.

Now notice that while I stated that a politician must be “competent” to rise in rank, I did not define what that means so far as a politician goes. A politician is someone whose job is to listen to thousands of people telling him what he should do and pulling him in different directions, and to act as a market trader based on all of the relative strengths of those stimuli. He goes out and trades on items that are neither a big win nor loss for him with other politicians to gain advances towards whatever the most profitable move is for himself — i.e. to stay in business as a politician. That is what I mean when I refer to a “competent” politician. He is not an expert on any area of knowledge. He may even be lousy at a topic. But he does know what the optimal balance of weight is that he should give to his electorate, lobbyists, and experts to insure that he doesn’t lose favor now, but that he also won’t screw himself over in the long run by (for example) approving something that has too high a risk of being harmful in the long run.

Someone who actually knew what he was doing would, almost certainly, annoy everyone because he would take strong measures within his field of expertise and at the end of the day strong measures are divisive and anything divisive is anathema to long-term success as a politician. Thus, by simple the truth of being a professional and accomplished politician, you are almost certainly never going to take strong measures unless there truly is an emergency and the experts need to be given more ear than others. So, even in the Federal government where we have the best and brightest of politicians, in general, their output will tend towards bland and ineffective. But more importantly, it’s very unlikely to be “bad”. Inefficient and less-than-optimal, certainly, but not harmful. It’s only at lower levels of government or, like in California where the politicians are forced to give more ear to one group (the electorate), that you will see truly harmful legislation go through. And so, it is at these levels of government that the strictest measures at limiting government capability have been enacted.

While this might not be a gleaming endorsement for the Federal government, it must still be noted that when a crisis comes, it is the experts who come to the fore, be that the economists, the Generals, the doctors, or whoever it is that is the group you would want and would rely on to supply the answer. If that time comes and those people are simply barred from taking the action they need to take, that is ultimately harmful. And so long as the Federal government can be generally trusted to do no worse than bland or inefficient, there is no particular risk by allowing exceptional behavior.

Conclusion

Personally, at the level of the Federal government, I would not recommend a balanced budget amendment. If I was to recommend one, it would allow for crisis/non-crisis budgets — the determination of which required no more than perhaps a 55% majority to pass — and some method of gradually working the debt down over a period of 15-18 years. In end result, I doubt there would be a significant difference between Federal spending as it has been, and Federal spending as it would be under the sort of amendment I would propose for actual passage. It would really only come into effect if the government attempted to do something patently silly.

At the moment, our one budgetary issue is that of health care. But the cost of health care between Medicare/Medicaid and private insurance is not significantly different. The problem is not governmental but systemic with how health care is priced in the US. One cannot cut spending of Medicare and Medicaid without reforming the private market as well. Attempting to do so would simply result in the government being unable to bid for care as doctors would have no incentive to accept half the money from the government for an operation, when private insurers still paid double the amount. A balanced budget amendment might force the government to entirely abandon providing health care insurance in-house, but to the average citizen the wasteful cost of care would remain and continue to bear down on our economy. Reform would still be necessary.

—

Debt graph image is licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license. Original file created by O18. Modified by Nick Anfinsen and Pdbailey.

What you will expect to see here are discussions of politics and tangentially economics. This blog will do its best to present a rational look at the world of today, how the modern world came into place, and the issues that are currently being discussed in the public realm.

What you will expect to see here are discussions of politics and tangentially economics. This blog will do its best to present a rational look at the world of today, how the modern world came into place, and the issues that are currently being discussed in the public realm.